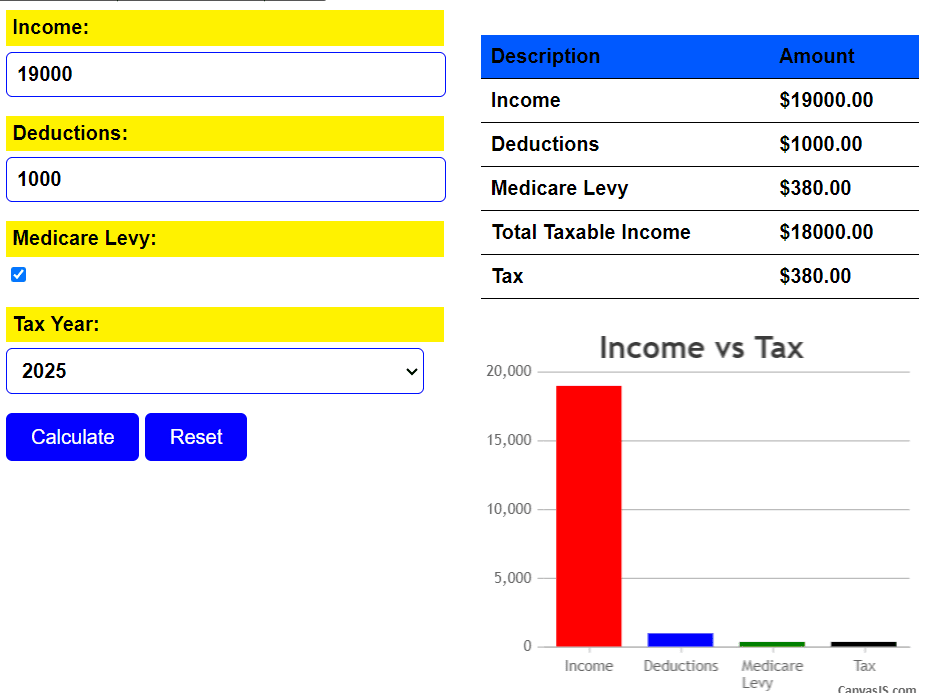

| Description | Amount |

|---|---|

| Income | |

| Deductions | |

| Medicare Levy | |

| Total Taxable Income | |

| Tax |

Understanding Tax Calculators

A tax calculator is an online tool that helps individuals estimate how much tax they need to pay based on their income, deductions, and other relevant factors. These calculators are designed to simplify the complex tax system and provide users with a clear idea of their tax liability.

| Income Range | Tax Rate (%) |

|---|---|

| $0 - $18,200 | 0 |

| $18,201 - $45,000 | 19 |

| $45,001 - $120,000 | 32.5 |

| $120,001 - $180,000 | 37 |

| $180,001 and over | 45 |

For the tax year 2025:

- Income up to $18,200: Tax rate is 0%

- Income between $18,201 and $45,000: Tax rate is 19%

- Income between $45,001 and $120,000: Tax rate is 32.5%

- Income between $120,001 and $180,000: Tax rate is 37%

- Income over $180,000: Tax rate is 45%

For the tax years 2024 and 2022, the tax brackets are the same as those for 2025.

For the tax year 2023:

- Income up to $18,200: Tax rate is 0%

- Income between $18,201 and $45,000: Tax rate is 19%

- Income between $45,001 and $120,000: Tax rate is 32%

- Income between $120,001 and $180,000: Tax rate is 37%

- Income over $180,000: Tax rate is 45%

These tax brackets determine the amount of tax an individual owes based on their taxable income.

Table:

| Tax Year | Taxable Income Range | Tax Rate (%) |

|---|---|---|

| 2025 | $0 - $18,200 | 0 |

| $18,201 - $45,000 | 19 | |

| $45,001 - $120,000 | 32.5 | |

| $120,001 - $180,000 | 37 |

| Over $180,000 | 45 |

|---|

| 2024 | Same as 2025 | Same as 2025 |

|---|---|---|

| 2023 | $0 - $18,200 | 0 |

| $18,201 - $45,000 | 19 | |

| $45,001 - $120,000 | 32 | |

| $120,001 - $180,000 | 37 | |

| Over $180,000 | 45 |

This table outlines the taxable income ranges and corresponding tax rates for each tax year from 2022 to 2025.

- Innovative Functionality: Tax calculators revolutionize the way Australians handle their taxes by offering innovative functionality. Users can input diverse financial details, such as income, allowances, and deductions, into the calculator. The tool then applies current tax rates and rules, swiftly computing the user's taxable income and resulting tax liability. This process, characterized by its speed and convenience, eradicates the need for cumbersome manual calculations.

- Empowering Accuracy: These calculators instill confidence in users through their precision. By meticulously considering all applicable tax rules and deductions, they minimize the risk of errors, ensuring accurate calculations. This precision is paramount in navigating Australia's complex tax landscape with ease and reliability. Next Tool Cd calculator

- Time-Efficient Solutions: Tax calculators are a time-saving marvel, liberating users from the arduous task of manual tax computation. With just a few clicks, individuals can access quick and dependable results, sparing them hours of tedious calculations prone to human error. This efficiency empowers users to allocate their time more effectively to other important endeavors.

- Dynamic Planning Tool: More than just a calculator, these tools serve as dynamic planning aids. Users can experiment with various scenarios, adjusting income levels and deductions to gauge their impact on tax liability. This versatility allows for informed financial decision-making and strategic tax planning, providing users with greater control over their fiscal future.

- Educational Resourcefulness: Tax calculators double as educational resources, offering invaluable insights into the intricacies of the Australian tax system. Through interactive features and detailed breakdowns, users gain a deeper understanding of how different financial factors influence their taxes. This educational component fosters financial literacy and empowers users to make informed fiscal choices. Other Top Tool Australian Tax Calculator

- Convenient Accessibility: Accessible anytime, anywhere, tax calculators redefine convenience in tax management. Their online accessibility allows users to calculate taxes effortlessly, whether at home, work, or on the go. This accessibility ensures that users can stay on top of their tax obligations with ease, without being confined by location or time constraints.

- Optimization Opportunities: By offering real-time updates and comparisons, tax calculators present users with optimization opportunities. Users can stay abreast of changes in tax laws and rates, ensuring their calculations remain accurate and up-to-date. Additionally, they can compare different financial scenarios to identify strategies that minimize tax burdens and maximize returns.

- Privacy and Security Assurance: Reputable tax calculators prioritize user privacy and data security. Employing robust encryption and stringent security measures, these tools safeguard sensitive financial information. This commitment to privacy and security instills confidence in users, assuring them that their personal and financial data remains protected at all times.