Future Value Calculator: Plan Your Financial Future with Confidence

Ever wondered how much your money could be worth in the years to come? The future value calculator is your secret weapon for navigating the world of finance. Whether you’re planning for retirement, saving for a dream vacation, or simply curious about the power of compound interest, this tool can be a game-changer.

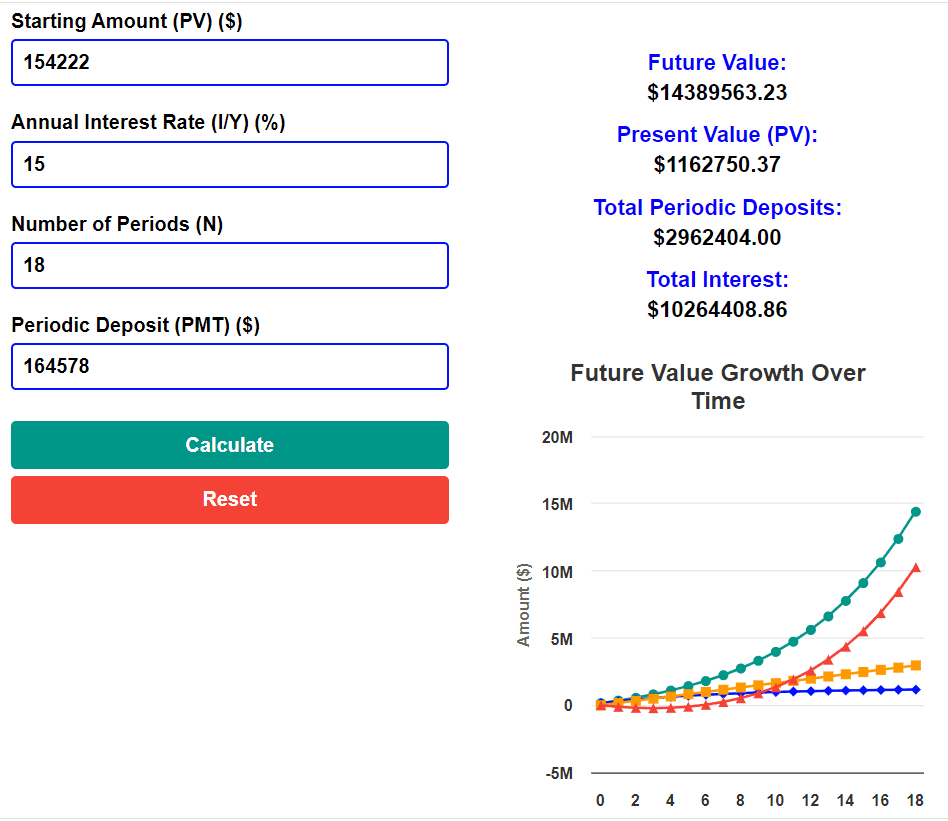

Future Value of Investment Calculator

The future value of investment calculator helps you estimate the potential growth of your investment over a specific period. It factors in the initial amount you invest (present value), the expected rate of return (interest rate), and the duration of your investment (time horizon). By understanding the future value, you can make informed decisions about your financial goals.

Here’s a scenario: Imagine you have $10,000 to invest and you’re considering two options – a savings account with a 1% interest rate or a mutual fund with a projected 8% annual return (remember, projected returns are not guaranteed). The future value calculator can show you that after 10 years, your savings account would grow to roughly $11,047, while the mutual fund could potentially reach a value of $21,589!

Present Value Calculator

The future value calculator’s partner-in-crime is the present value calculator. While the future value calculator tells you how much your investment will be worth in the future, the present value calculator works the other way around. It helps you determine how much you need to invest today to achieve a specific future goal.

For example, say you want to have $1 million saved up for retirement in 30 years. The present value calculator can tell you how much you need to invest regularly (considering a specific interest rate) to reach your target amount. Click Here Next Calculator

Future Value Compound Interest Calculator

The magic behind the future value calculator lies in the power of compound interest. Compound interest is often referred to as “interest on interest.” Basically, it’s the interest you earn not just on your initial investment, but also on the accumulated interest from previous periods. This snowball effect can significantly increase the future value of your investment.

The future value compound interest calculator specifically takes compound interest into account, providing a more accurate picture of your investment’s growth.

Future Value Calculator Formula

For the curious minds out there, the future value formula is:

Future Value (FV) = Present Value (PV) x (1 + Interest Rate)^Number of Periods

While the calculator does the heavy lifting, understanding the formula can deepen your understanding of how future value is calculated.

SIP Future Value Calculator

SIP, or Systematic Investment Plan, is a popular investment strategy in India where you invest a fixed amount regularly (often monthly) in mutual funds. The SIP future value calculator can be a valuable tool for Indian investors planning their long-term financial goals.

Here’s a note for our US readers: While SIPs are not as common in the US, the concept of regular contributions is still applicable. You can utilize the future value calculator and adjust the “number of periods” section to reflect your planned contribution frequency (monthly, quarterly, etc.).

Future Value Calculator Monthly

Many future value calculators allow you to specify the frequency of compounding. This is particularly helpful if you’re planning on making regular contributions (like with a monthly SIP). Using a future value calculator with a monthly compounding option can provide a more accurate picture of your investment’s growth.

Future Value Calculator Groww

Groww is a popular investment platform in India that offers a future value calculator among its suite of tools. There are many other reputable future value calculators available online, so feel free to explore and find one that suits your needs.

Remember: The future value calculator is a fantastic tool for financial planning, but it’s important to consider factors like market fluctuations and inflation when making financial decisions.

By understanding the power of compound interest and using the future value calculator effectively, you can take control of your financial future and achieve your financial goals with confidence!

What are the limitations of future value?

Future value calculations provide estimates based on assumptions about interest rates and investment performance. Limitations include:

Assumption Sensitivity: Changes in interest rates can significantly alter projected values.

Market Volatility: Fluctuations in market conditions may affect actual returns.

Inflation Impact: Future values do not always account for inflation’s erosion of purchasing power.

What is involved in the future value calculator?

A Future Value Calculator typically requires inputs such as:

Initial investment amount

Annual interest rate

Time period of investment

Frequency of contributions (if applicable, e.g., monthly SIPs)

What do future value calculations consider?

Future value calculations take into account:

Compound interest: Interest earned on both the initial principal and accumulated interest.

Time horizon: Duration over which investments grow.

Regular contributions: Additional deposits that increase the principal amount over time.

फ्यूचर वैल्यू कैलकुलेटर में क्या शामिल है? (What is involved in the Future Value Calculator?)

फ्यूचर वैल्यू कैलकुलेटर में निम्नलिखित शामिल होता है:

प्रारंभिक निवेश राशि

वार्षिक ब्याज दर

निवेश की अवधि

योजना की अवधि के अनुसार मासिक योगदान (यदि लागू हो)

यह इन इनपुट्स का उपयोग करके ब्याज पर संयुक्त रूप से रूप से निवेश के अपेक्षित भविष्य मूल्य की गणना करता है।

What is the future value used for?

Future value is used to:

Plan for retirement savings

Evaluate investment opportunities

Calculate the growth of savings over time

Set financial goals based on projected returns

What is the formula for predicting future value?

The future value formula is: FV = PV x (1 + r)^n, where:

FV = Future Value

PV = Present Value

r = Interest Rate (as a decimal)

n = Number of investment periods

Remember: The future value calculator is a fantastic tool, but it’s important to consider factors like inflation and market fluctuations when making financial decisions. Consulting with a financial advisor can provide personalized guidance for your specific situation.